On January 11, 2017, the Town of Yarmouth was the first in Nova Scotia to enact a by-law establishing a Development Rebate Program, designed to stimulate building construction and expand the Town's economy.

The Town of Yarmouth’s By-Law 65, cited as the “Central Business District Improvement Plan By-Law” takes advantage of the recent change to the Municipal Government Act (through Bill 177) to “authorize municipal councils to make a by-law providing for the phasing-in, over a period of up to 10 years, of an increase to the taxable assessed value of certain or contaminated properties located in a commercial development district established by by-law and further providing for the cancellation, reduction or refund of taxes paid as a result of the phasing-in.”

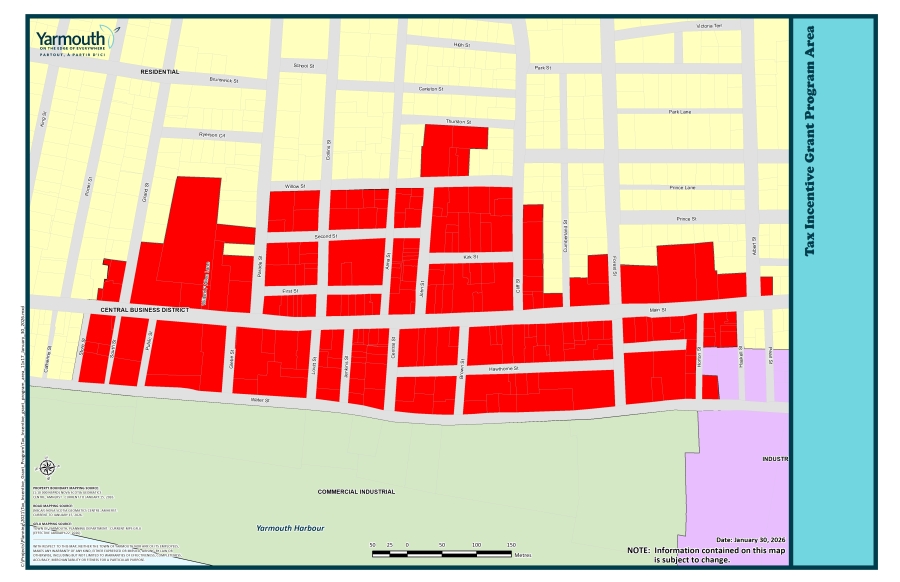

This means that property owners within the Central Business District (shown in the image below) can apply for annual partial rebates of up to ten years on commercial taxes if they have undertaken the development of the property.

Development can include new building construction, or the expansion of an existing building to realize more effective utilization of the property’s potential.

Eligible property must enter into a Phased In Assessment Agreement with the Town prior to receiving a development rebate. More details can be found in the attachment at the bottom of this page. To get started, check out the full pdf Central Business District Improvement Plan By-Law(171 KB) , and contact Town of Yarmouth Economic Development, Natalie Smith, at edo@townofyarmouth.ca or (902) 742-1505.